Understanding cost benefit analysis vegetable oil sweeping Kandla Port is critical for investment decisions. The detailed cost benefit analysis vegetable oil sweeping Kandla Port reveals financial advantages of Squeeze operations. Marine Super Cargo specializes in cost benefit analysis vegetable oil sweeping Kandla Port through comprehensive financial modeling and operational data.

Cost benefit analysis vegetable oil sweeping Kandla Port encompasses direct costs, operational savings, and revenue enhancement. Maritime professionals conducting cost benefit analysis vegetable oil sweeping Kandla Port justify equipment investments while optimizing financial performance. The cost benefit analysis vegetable oil sweeping Kandla Port framework quantifies tangible and intangible benefits throughout operations.

Modern cost benefit analysis vegetable oil sweeping Kandla Port demonstrates compelling financial returns and competitive advantages. Cost benefit analysis vegetable oil sweeping Kandla Port expertise enables vessel operators to make data-driven decisions supporting profitability. Cost benefit analysis vegetable oil sweeping Kandla Port directly influences capital allocation and operational strategy.

Effective cost benefit analysis vegetable oil sweeping Kandla Port requires comprehensive understanding of cost structures, benefit quantification, and financial modeling throughout chemical tanker operations.

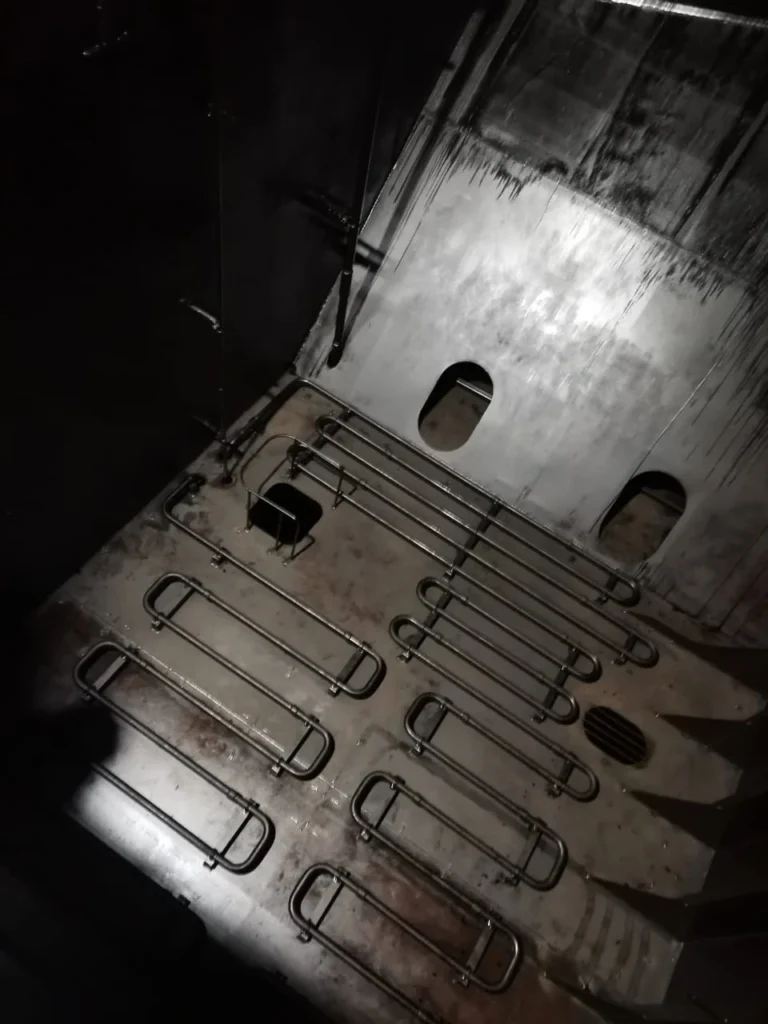

Direct Cost Components

Vegetable oil procurement costs represent primary recurring expense ranging from USD 800-1500 per metric ton depending on supply sources and quality specifications.

Equipment investment includes storage tanks, pumping systems, and application equipment requiring initial capital expenditure of USD 15,000-50,000 depending on vessel size.

Training expenses cover crew education and certification programs establishing competency throughout operational implementation. cost benefit analysis vegetable oil sweeping

Maintenance costs address equipment servicing and component replacement throughout operational lifecycles.

Operational Savings Quantification

Cargo recovery improvement of 0.3-0.5% translates to significant revenue enhancement on typical cargo parcels throughout discharge operations at Kandla.

Demurrage reduction through faster cleaning saves USD 15,000-30,000 per day depending on vessel size and charter rates throughout port operations.

Water consumption elimination saves ballast handling costs and reduces environmental compliance expenses throughout cleaning procedures.

Energy cost reduction through eliminated heating requirements saves fuel consumption throughout tropical operations at Kandla Port. cost benefit analysis vegetable oil sweeping

Revenue Enhancement Benefits

Increased cargo outturn generates additional freight earnings directly proportional to recovery improvement throughout commercial operations.

Premium charter rates become achievable through demonstrated cleaning excellence supporting competitive positioning throughout market negotiations.

Reduced claims exposure prevents financial settlements averaging USD 10,000-100,000 per incident throughout operational risk management.

Customer retention improves through service quality supporting long-term commercial relationships throughout charter business. cost benefit analysis vegetable oil sweeping

Time Value Calculations

Port stay reduction of 6-12 hours generates significant savings through decreased berth fees and improved vessel utilization throughout operational cycles.

Voyage frequency increase enables additional annual earnings through enhanced fleet productivity throughout operational years.

Crew productivity gains through efficient procedures support operational effectiveness throughout vessel management.

Scheduling reliability improves commercial reputation supporting charter market positioning throughout business development. cost benefit analysis vegetable oil sweeping

Environmental Compliance Economics

MARPOL Annex II compliance costs reduce through biodegradable agent use eliminating potential penalties throughout regulatory inspections.

Waste management savings result from simplified disposal procedures reducing shore facility charges throughout operations.

Insurance premium reductions reflect lower environmental risk exposure supporting long-term cost management throughout vessel operations.

Regulatory preparedness prevents future compliance costs as environmental standards evolve throughout IMO guidelines implementation.

Payback Period Analysis

Typical payback periods range from 8-18 months based on vessel operational frequency and cargo types throughout financial modeling.

High-activity vessels achieve faster returns through frequent application and cumulative savings throughout operational cycles.

Cargo value influences payback calculations with higher-value products generating greater recovery benefits throughout revenue analysis.

Charter market conditions affect revenue potential influencing overall return on investment throughout financial assessments.

Risk-Adjusted Returns

Downside protection through claims prevention provides risk mitigation value throughout investment evaluation processes.

Operational reliability reduces off-hire risks supporting consistent revenue generation throughout charter performance.

Market volatility resistance through operational excellence supports stable financial performance throughout economic cycles.

Competitive positioning protection maintains market share supporting long-term business sustainability throughout industry evolution.

Comparative Analysis

Traditional cleaning methods comparison reveals higher water costs, energy consumption, and extended cleaning duration throughout baseline assessments.

Chemical cleaning alternatives demonstrate higher material costs and environmental compliance expenses throughout comparative evaluation.

Manual cleaning options show increased labor requirements and safety risks throughout operational comparison.

Hot water washing exhibits significant energy costs and equipment wear throughout alternative method analysis.

For comprehensive guidance on implementing strategic commercial economic impact Squeeze Kandla optimization with financial modeling, maritime professionals should consult experienced specialists.

Sensitivity Analysis

Oil price variations affect procurement costs requiring flexible sourcing strategies throughout cost management.

Charter rate fluctuations influence revenue benefits affecting overall return calculations throughout market analysis.

Operational frequency changes impact cumulative savings determining investment viability throughout financial planning.

Regulatory changes may affect compliance costs requiring adaptation throughout long-term financial projections.

Implementation Economics

Phased rollout strategies minimize initial investment spreading costs throughout gradual implementation.

Training efficiency improvements reduce learning curve expenses supporting faster payback throughout operational adoption.

Equipment standardization enables bulk procurement reducing unit costs throughout fleet implementation.

Performance optimization increases benefits over time supporting enhanced returns throughout operational maturity.

Frequently Asked Questions

Q1: What are the typical annual savings from vegetable oil sweeping at Kandla Port?

Annual savings range from USD 50,000-200,000 per vessel depending on operational frequency, cargo types, and charter rates throughout operations.

Q2: How much does vegetable oil sweeping equipment investment cost?

Initial equipment investment typically ranges from USD 15,000-50,000 depending on vessel size and system complexity throughout implementation.

Q3: What is the expected payback period for Squeeze investment?

Payback periods typically range from 8-18 months based on operational frequency and cargo characteristics throughout financial analysis.

Q4: How does vegetable oil sweeping compare economically to traditional methods?

Vegetable oil sweeping demonstrates 30-50% cost savings compared to traditional water wash methods while improving cargo recovery throughout operations.

Q5: What factors most significantly affect cost-benefit outcomes?

Operational frequency, cargo value, charter rates, and vegetable oil procurement costs most significantly influence financial returns throughout economic analysis.